center for responsible lending overdraft fees

Center for Responsible Lending CRL Policy and Litigation Counsel Nadine Chabrier issued the following statement. Limit the number of fees they can charge to 1 per month and 6 per year.

Bank overdraft practices cause many families severe financial distress in the best of times.

. Overdraft Fees Facts. Overdraft fees kick people when they are down. The Center for Responsible Lending CRL applauds Bank of America for taking another important step that prevents costly overdraft fees for consumers.

The Center for Responsible Lending CRL issued a report on June 3 calling on Congress to adopt legislation prohibiting banks from issuing overdraft fees for the duration of the COVID-19 pandemic. These fees include both overdraft fees as well as non-sufficient. WASHINGTON DC Bank of America Americas second-largest retail bank with about 235 trillion in assets today announced it will reduce overdraft fees and non-sufficient funds NSF fees aka bounced check fees for its consumer banking customers.

Overdraft fees have a punishing impact on financially vulnerable Americans often ousting them from the banking system altogether said Gary Kalman executive vice president of CRL. 2 It is affiliated with the Self-Help Credit Union also founded by Martin Eakes in Durham NC. Banks collected the bulk of total overdraft-related fee income in 2019.

The study found that nearly 80 of bank overdraft and NSF fees are borne by only 8 of account holders who incur ten or more fees per year with many of those customers paying far more. These overdraft fees add up. District of Columbia Office 910 17th Street NW Suite 800 Washington DC 20006.

Overdraft fees collected by large banks continued to rise in 2019 according to a new report and those fees are expected to grow even more in 2020 as the. The bank typically charges a fee averaging 35 for each individual overdraft transaction it pays. Which total 175 billion per year according to the Center for Responsible Lending.

Last year banks with assets of 1 billion or more charged customers 1168 billion in overdraft and non-sufficient fund fees according to a. The Center for Responsible Lending found that large US. The Center for Responsible Lending CRL issued a report on June 3 calling on Congress to adopt legislation prohibiting banks from issuing overdraft fees for the duration of the COVID-19 pandemic.

These overdraft fees make banks the very institutions we trust to safeguard our funds a hostile place for many of our nations most vulnerable financial households to put their money said Ashley Harrington federal advocacy director at the Center for Responsible Lending. By Mary Williams Walsh Published June 3 2020 Updated June 22 2021 Large US. It is the biggest bank thus far to do this.

A new report released today by the Center for Responsible Lending CRL finds that in 2019 banks collected more than 1168 billion in overdraft-related fees through abusive practices that drain massive sums from consumers checking accounts. Empower consumers by requiring that they proactively opt-in to overdraft programs in the first place rather than automatically being enrolled. Their costs are borne by financially vulnerable consumers.

Whats worse these fees can quickly accumulate resulting in hundreds of dollars in fees per year. According to a study by the Center for Responsible Lending big banks collected more than 11 billion in overdraft fees in 2019. The group says despite the pandemic it didnt get any better in 2020.

Courtesy of Wells Fargo multimedia resources Dive Brief. Banks took 1168 billion in overdraft fees out of their customers accounts last year even before the. Center for Responsible Lending 302 West Main Street Durham NC 27701 919 313-8500.

Banks took 1168 billion in overdraft fees out of their customers accounts last year the Center for Responsible Lending said according to data released Wednesday that focused on financial institutions with 1 billion or more in assets. Overdraft fees are triggered by debit card point-of-sale POS transactions ATM withdrawals electronic bill payments and paper checks. Its clearly unacceptable and it should be illegal.

During the economic crisis caused by COVID-19 the devastating impact of overdraft fees are only more pronounced said CRL Senior Researcher Peter Smith who co-authored the report. Center for Responsible Lending CRL President Mike Calhoun issued the following statement. A new report from the Center for Responsible Lending CRL shows.

Ive been working to reduce or eliminate overdraft fees for 20 years and to give them credit they really did listen said Martin Eakes CEO of the Center. For one group of hard hit consumers the median number of overdraft fees was 37 nearly 1300 annually. Never Pay Another Overdraft Fee.

Banks Must Stop Gouging Consumers During the COVID-19 Crisis. In 2019 banks with assets of 1 billion or more charged customers 1168 billion in overdraft-related fees. These fees disproportionately harm Black and Latino Americans with a bank account.

Overdraft protection a feature of. Established in 2002 by Self-Help CRL is a nonprofit nonpartisan research and policy organization that focuses on financial products and services including mortgages credit cards payday lending and bank overdraft fees.

How Can I Avoid Business Overdraft Fees Revenued

The Real Cost Of Overdraft Fees American Banker

Maloney Joins With Consumer Advocates To Introduce Overdraft Protection Act Of 2019 Congresswoman Carolyn Maloney

Michael Calhoun Center For Responsible Lending

Small Banks Face Bigger Threat To Overdraft Fees This Time Around American Banker

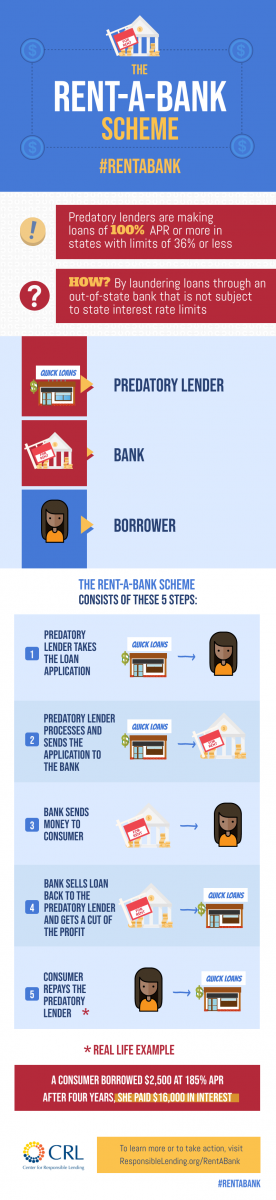

Center For Responsible Lending Endorses The Bipartisan Veterans And Consumers Fair Credit Act Which Caps Interest Rates Nationally At 36 Center For Responsible Lending

Center For Responsible Lending Facebook

Banks Earning Less From Overdrafts But Critics Still Find Fault American Banker

Report Finds Bank Overdraft Fees Climbed In 2019 For Fourth Straight Year Morning Consult

Auto Loans Center For Responsible Lending

Overdrawn And Overworked How Banks Are Still Screwing Consumers With Overdraft Fees Occupy Com

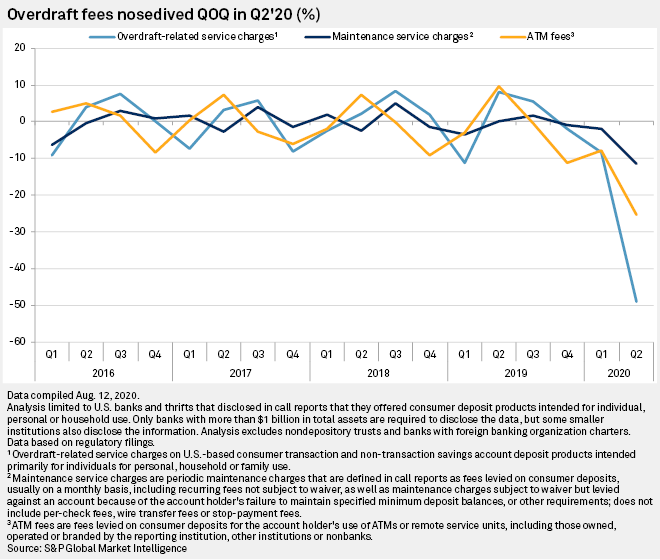

Overdraft Fees Plunge 49 Due To Covid 19 Shutdown S P Global Market Intelligence

Center For Responsible Lending Facebook